KLCC REIT Corporate Profile

KLCC REIT is Malaysia’s largest real estate investment trust and is part of a stapled security together with KLCCP, forming the only staple security in the country.

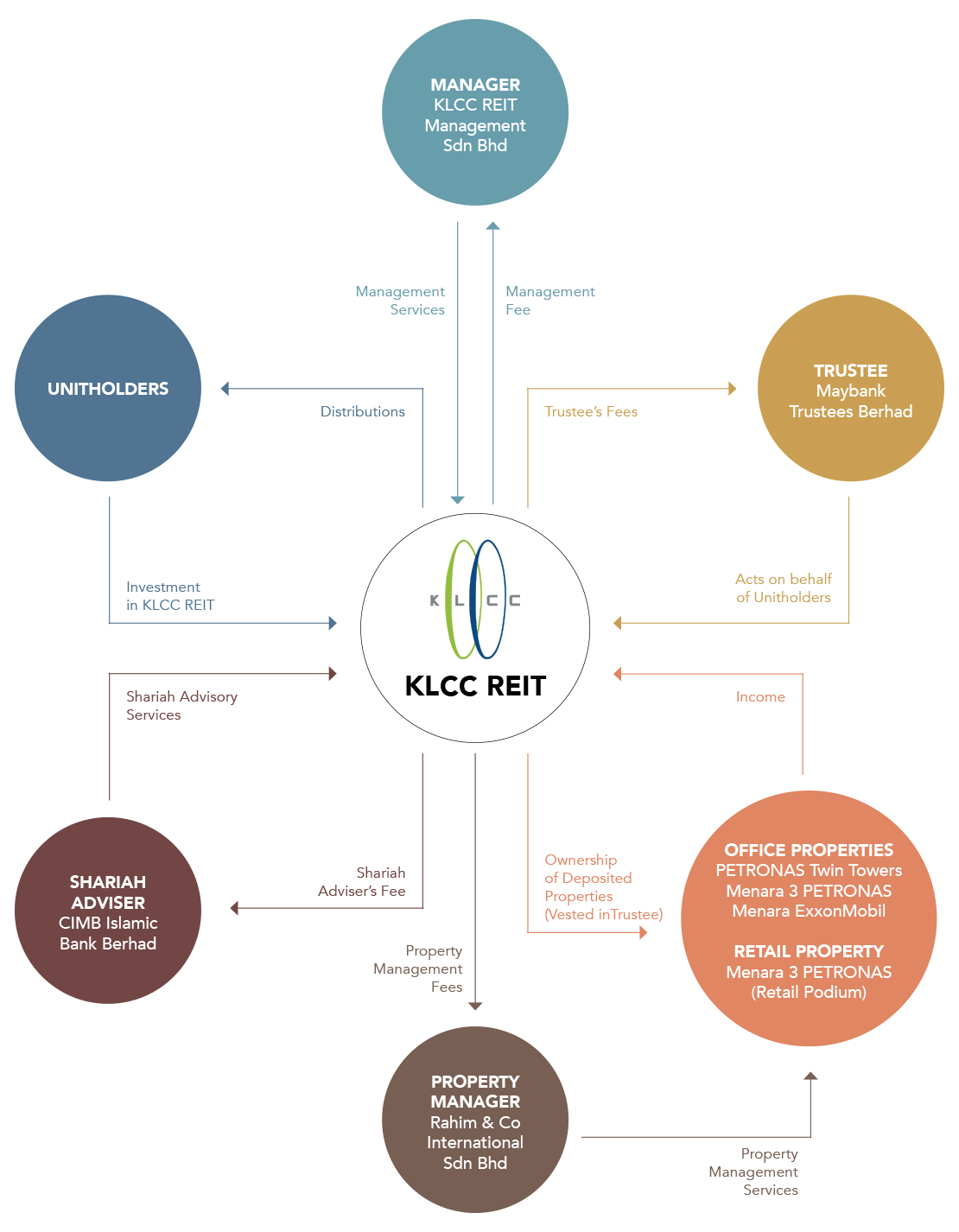

KLCC REIT is an Islamic Real Estate Investment Trust established to own and invest primarily in Shariah compliant real estate for office and retail purposes. The Fund was constituted by the Deed dated 2 April 2013 entered into between the Manager and Maybank Trustees Berhad (“the Trustee”). The Deed was registered and lodged with the Securities Commission (SC) on 9 April 2013 and the Fund was listed on the Main Board of Bursa Malaysia Securities Berhad on 9 May 2013.

OBJECTIVE

Investment Strategies

Focused on active asset management and acquisition growth strategy to provide regular and stable distributions to unitholders and ensure capital growth and improved returns from its property portfolio.

ACTIVE ASSET MANAGEMENT STRATEGY

Optimise the rental and occupancy rates and the Net Lettable Area (NLA) of the properties in order to improve the returns from KLCC REIT’s property portfolio.

ACQUISITION GROWTH STRATEGY

Acquire real estate that fit with KLCC REIT's investment policy and strategy to enhance the returns to the unitholders and capitalise on opportunities for future income and Net Asset Value (NAV) growth.

KLCC REIT salient features :

| Name of Fund | KLCC Real Estate Investment Trust (KLCC REIT) |

|---|---|

| Fund Type | Income and growth |

| Fund Category | Islamic Real Estate Investment Trust |

| Approved Fund Size | 1,805,333,083 units |

| The Manager | KLCC REIT Management Sdn Bhd |

| The Trustee | Maybank Trustees Berhad |

| Investment objective | To provide the unitholders with regular and stable distributions, improving returns from its property portfolio and capital growth, while maintaining an appropriate capital structure |

| Investment policy | To invest, directly and indirectly, in a Shariah-compliant portfolio of income producing Real Estate used primarily for office and retail purposes in Malaysia and overseas |

| Distribution policy |

95% of KLCC REIT’s distributable income for FY2013 and FY2014 and at least 90% for each subsequent financial year Distributions are made on a quarterly basis |

| Gearing policy | Up to 50% of total asset value of the Fund |

| Listing Date | 9 May 2013 |

| Deed | The Deed dated 2 April 2013 between the Manager and the Trustee, constituting KLCC REIT and registered with the Securities Commission on 9 April 2013 |

| Stapling Deed | Stapling Deed dated 2 April 2013 amongst the Manager, Trustee and KLCCP |

| Stock Name | KLCC |

| Stock Code | 5235SS |